Navigating health insurance can be a daunting task, especially when you’re already dealing with the stress of a cancer diagnosis and treatment. One of the less obvious pitfalls involves in-network physicians who use out-of-network facilities or services. This can result in unexpected and often substantial out-of-pocket expenses. Below, we explore some essential questions to ask to ensure you avoid these hidden costs.

Even if your physician is in-network, they might use a surgical center, pathology team, or lab services not covered by your insurance. This discrepancy can lead to significant, unexpected expenses.

For example, your surgery might be fully covered if performed at one facility, but could cost thousands more at another if it falls outside your insurance network. It’s crucial to be proactive and ask the right questions before scheduling any procedure or test.

1) Is every aspect of my procedure covered?

Ask if the surgical center, pathology team, lab services, and any other related providers are all in-network. If not, find out what the out-of-pocket costs will be for using those services.

2) Where does my physician have privileges?

Physicians often have privileges at multiple facilities. If your initially scheduled location is out-of-network, ask for alternative in-network options where your physician can perform the procedure.

3) Can I get a detailed list of services and providers involved in my care?

Request a comprehensive list of everyone and everything involved in your care to verify that your insurance covers them all in-network. Examples include the anesthesiologist and support service providers like physical or occupational therapists for recovery care.

4) How do I confirm my coverage?

Double-check with your insurance company and ask for the confirmation in writing. Provide them with the details of your procedure, including the names of all facilities and providers, to confirm that everything is covered.

5) What are the potential out-of-pocket costs?

Ask for an estimate of any out-of-pocket costs for both in-network and out-of-network scenarios. This will help you make an informed decision.

Being proactive and informed can save you from unexpected financial burdens. By asking these questions and taking these steps, you can focus more on your health and less on worrying about surprise medical bills.

Remember, it’s your right to understand your coverage and ensure you’re not caught off guard by hidden costs.

By asking the right questions and ensuring every aspect of your procedure is covered, you can avoid unexpected costs and focus on your recovery. For more tips, support, and shared experiences, download the Outcomes4Me app. Connect with other cancer patients and survivors, share your story, and learn from the community. Together, we can navigate these challenges and empower each other on the path to better health.

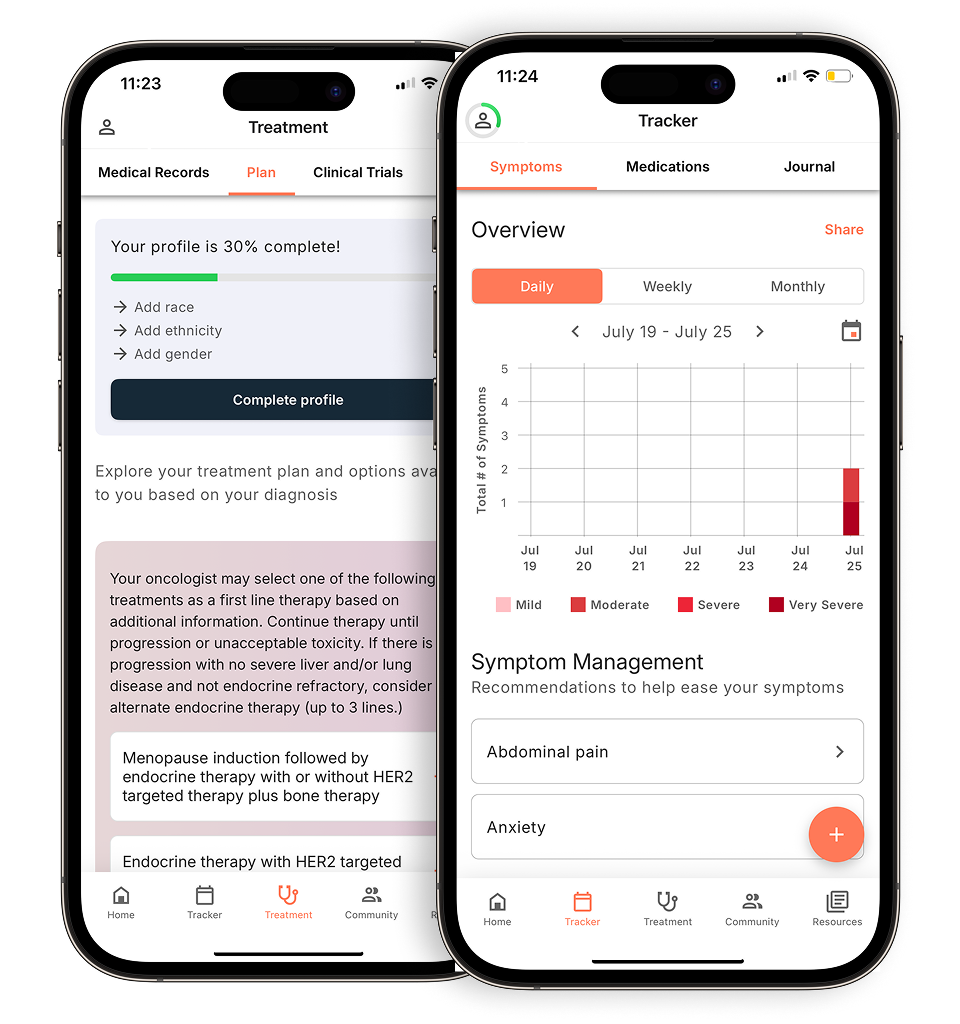

Personalized support for real care decisions

Understand your diagnosis, explore clinical trials, and track symptoms--all in one place.

Get started

Compare treatments, prepare for appointments, and track side effects—all in the app

Built for your diagnosis, Outcomes4Me gives you the tools to make confident, informed decisions—right when you need them.

Continue in app