August is National Make-A-Will Month, and in recognition of this important awareness month, Outcomes4Me is sharing related, helpful resources with our patient members.

The idea of “getting our affairs in order” has its unique set of challenges that most of us don’t want to think about until absolutely necessary. However, ensuring that your loved ones inherit your assets as you intend can bring immense peace of mind to both you and your family.

By taking proactive steps early, you can feel secure that your wishes are clearly communicated to those close to you. We’re here to provide three essential tips to help you navigate this important process.

Create a will and review your assets

A will helps clearly outline your wishes regarding the distribution of your assets. Your assets can be anything from property, investments, jewelry, sentimental items, and even digital assets. It’s a common misconception that only people with a lot of wealth need a will, but it’s a crucial step that puts you in control (rather than the state) of the distribution of your assets. Everyone should have a will, regardless of income status.

To learn more about how to create a will, read our “How do I create will?” blog here.

Create your estate plan

Although a will is a part of your estate plan, estate planning takes into consideration things like a healthcare proxy, advance directive, and a living will. If you’re unsure of where to start, you can talk to an attorney or utilize an online platform like Trust & Will that offers guided resources to help you create your estate plan.

Organize and update important documents

Keep all your important documents, such as your will, trust documents, insurance policies, and financial records, in a safe and accessible place. Tell someone you trust where these documents are located and don’t forget to update them after life changes.

By taking these steps, you can help ensure that your loved ones are cared for and your preferences are honored.

To coincide with National Make-A-Will Month, Outcomes4Me has teamed up with Trust & Will to offer our members a 20% discount on estate planning offerings. Use this link to receive your discounted estate planning services.

This post contains affiliate links. If you click on one of these links and make a purchase, we may receive a commission.

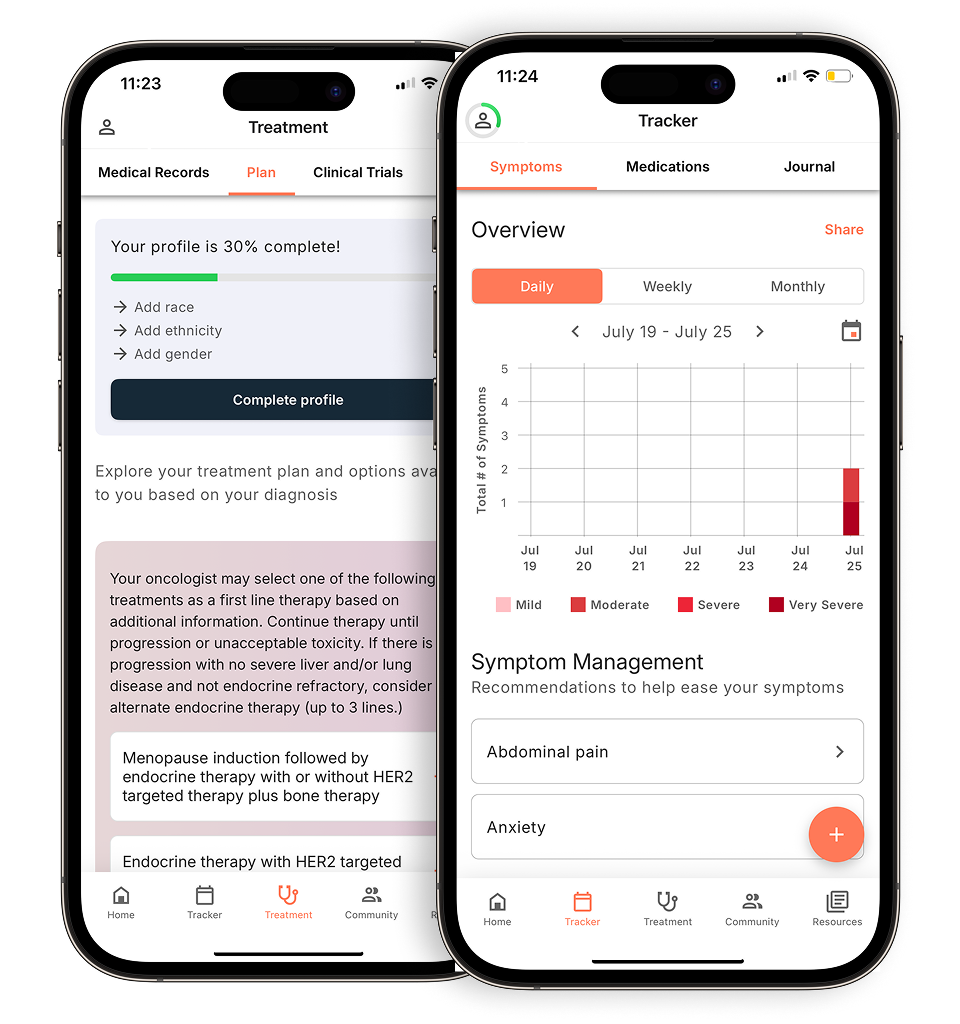

Personalized support for real care decisions

Understand your diagnosis, explore clinical trials, and track symptoms--all in one place.

Get started

Compare treatments, prepare for appointments, and track side effects—all in the app

Built for your diagnosis, Outcomes4Me gives you the tools to make confident, informed decisions—right when you need them.

Continue in app