Maybe you looked into genetic testing a few years ago and were told you didn’t qualify for coverage. Or perhaps the potential cost was so high you decided to wait. It might be time to look again. The world of genetics is changing quickly, and so are the rules for brca test insurance. Thanks to new research and updated clinical guidelines, the BRCA testing insurance coverage criteria have expanded. This means you may be eligible now, even if you weren’t before. Here’s what you need to know about the changes and how they could affect you.

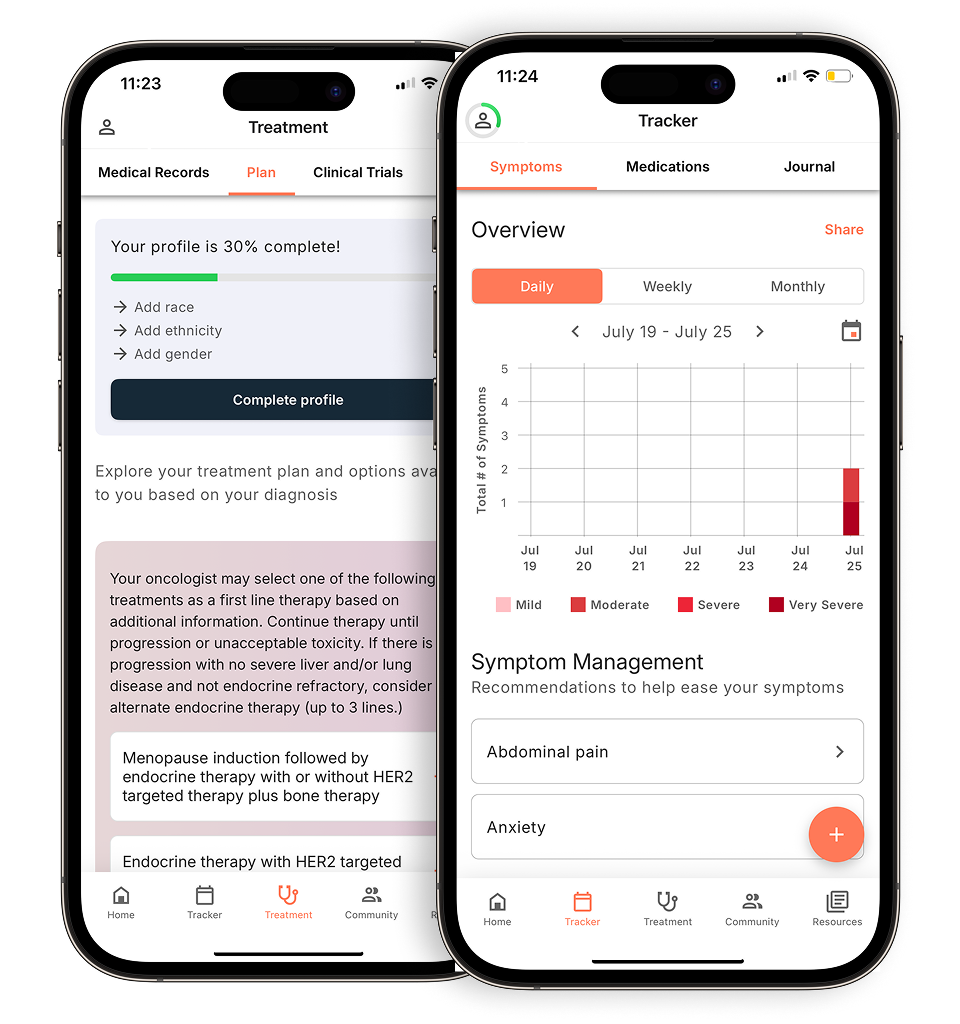

View your personalized treatment plan in the Outcomes4Me app

Use your diagnosis to unlock personalized NCCN Guidelines®-aligned recommendations.

Key Takeaways

- Use genetic insights to be proactive: Testing gives you a clear picture of your inherited risk, allowing you to work with your doctor on a personalized screening and prevention plan instead of waiting to react to a diagnosis.

- Understand how insurance coverage works: Most plans cover genetic testing when it’s medically necessary, based on your personal and family health history. Don’t assume it isn’t an option for you, as federal laws also mandate coverage for many high-risk individuals.

- Lean on experts for support: A genetic counselor can be your best advocate by helping with insurance approval and explaining your results, while financial assistance programs exist to help manage any out-of-pocket costs.

What Is Genetic Testing for Breast Cancer, Really?

When you hear “genetic testing,” it might sound complicated, but the idea behind it is pretty straightforward: it’s about understanding your body’s unique blueprint. For breast cancer, genetic testing looks for specific inherited changes, or mutations, in your genes that could increase your risk of developing the disease. Think of it as getting a personalized heads-up about your health so you can be more proactive.

The most well-known genes tested for are BRCA1 and BRCA2. Normally, these genes help protect you from cancer by repairing DNA damage and keeping cell growth in check. However, if you inherit a mutated copy of one of these genes, that protective function is less effective. This doesn’t mean you will definitely get cancer, but it does mean your risk is significantly higher than average. A BRCA gene test can identify these mutations, giving you and your doctor powerful information to work with.

Knowing your genetic risk empowers you to take control. It shifts the conversation from reaction to prevention and allows you to make informed decisions about your future health. With this knowledge, you can create a personalized screening plan and discuss preventive options with your healthcare team. It’s about turning uncertainty into actionable steps.

What You Need to Know About BRCA1 and BRCA2

So, who should consider getting tested for BRCA1 and BRCA2 mutations? Your doctor will likely recommend it if certain patterns show up in your family’s health history. This includes having close relatives who were diagnosed with breast, ovarian, prostate, or pancreatic cancer. The age of diagnosis matters, too—for example, if a close family member was diagnosed with breast cancer before age 50.

Another key factor is your ancestry. People of Ashkenazi Jewish descent have a higher prevalence of BRCA mutations, making testing a more common recommendation for this group. Talking through your family health history with your doctor is the best first step to determine if genetic testing is right for you.

More Than Just BRCA: Other Genes to Know

While BRCA1 and BRCA2 get most of the attention, they are just two pieces of a much larger genetic puzzle. Scientists have identified several other genes that, when mutated, can also increase your risk for breast cancer. Genes like PALB2, CHEK2, ATM, TP53, and CDH1 are also important players. A mutation in one of these might not carry the same level of risk as a BRCA mutation, but it still provides crucial information for you and your doctor to create a proactive health plan.

Think of it this way: if your genetic code is a book of instructions for your body, BRCA genes are just one chapter. Understanding the full story requires looking at other chapters, too. Knowing about these other genes helps create a more complete picture of your inherited risk, which is the first step toward personalized screening and prevention strategies tailored specifically to you.

Understanding Multi-Gene Panels

In the past, genetic testing was a bit like searching for a needle in a haystack, often focusing only on the BRCA1 and BRCA2 genes. Today, the approach is much more comprehensive. Most doctors now use what’s called a multi-gene panel test. Instead of looking at just one or two genes, these panels test a whole group of them—sometimes dozens—all at once. This is a more efficient and thorough way to assess your hereditary cancer risk.

This type of panel testing gives you and your healthcare team a broader view of your genetic makeup. It can identify mutations in less common genes that might have been missed with older testing methods. This detailed insight allows for a more nuanced conversation about your specific risk level and what screening or preventive measures make the most sense for your situation.

Why Testing an Affected Relative First is Key

If you’re considering genetic testing because a close family member has had breast cancer, here’s a key piece of advice: the most informative first step is for your affected relative to be the one who gets tested. It might seem counterintuitive, but there’s a strategic reason for this. If they test positive for a specific gene mutation, it essentially gives your family a clear genetic signpost. The lab then knows exactly what to look for in your DNA.

This approach makes your own test results much more definitive. Instead of a broad search, your test becomes a simple yes-or-no question: do you have that same specific mutation? It’s a more direct and often more affordable path to getting the answers you need. If your affected relative tests negative for any known mutations, that information is also valuable, as it may suggest that the cancer in your family isn’t linked to a known high-risk gene.

Understanding Your Genetic Risk in Numbers

Hearing about “increased risk” can feel overwhelming, but putting some numbers to it can help demystify what it actually means. It’s important to remember that genetics are about probability, not certainty. A gene mutation doesn’t mean a cancer diagnosis is inevitable; it just means the odds are different, and it’s a signal to be more vigilant with your health. Let’s break down what the statistics really tell us about hereditary cancer and lifetime risk.

How Many Cancers are Actually Hereditary?

One of the most common misconceptions about breast cancer is that it’s almost always passed down through families. The reality is that most breast cancers are not caused by an inherited gene mutation. According to research, only about 5% to 10% of all breast cancers in the United States are considered hereditary. The vast majority are “sporadic,” meaning they occur due to a combination of factors like aging, lifestyle, and environmental exposures rather than a single gene passed from a parent.

This statistic can be both surprising and reassuring. It highlights that while family history is an important risk factor, it’s not the only one. For many people, it reinforces the importance of proactive health choices and regular screenings, regardless of their genetic background. Understanding this helps put your own family history into a clearer context and can guide a more productive conversation with your doctor about your overall risk.

Comparing Lifetime Cancer Risk

So what does it mean to have a “high-risk” gene mutation in terms of numbers? For the average woman in the U.S., the lifetime risk of developing breast cancer is about 13%. This means that out of every 100 women, about 13 will be diagnosed with breast cancer at some point in their lives. When a high-risk gene mutation like BRCA1 or BRCA2 is present, that lifetime risk jumps significantly, often to 20% or higher—in some cases, much higher.

Knowing this allows you to move from a general screening schedule to a personalized one. Your doctor might recommend more frequent mammograms, starting them at a younger age, or adding other imaging like breast MRIs. This is where knowledge becomes power. By understanding your specific risk level, you can work with your healthcare team to build a proactive surveillance plan that is right for you, turning statistics into actionable steps for your health.

How Genetic Testing Can Inform Your Health Choices

The goal of genetic testing isn’t just to find a risk; it’s to do something about it. This is where genetic counseling comes in. A genetic counselor is a specialist who helps you understand your test results and what they mean for you and your family. They can help you map out a plan for managing your risk, which might include more frequent screenings (like mammograms or MRIs), medications, or preventive surgeries.

This proactive approach can make a world of difference. Early detection saves lives, and knowing you’re at a higher risk allows you to be vigilant. Many insurance plans are now required to cover genetic counseling and testing for women who are at an increased risk, making these preventive services more accessible than ever.

Is BRCA Gene Testing Covered by Insurance?

Figuring out if you qualify for genetic testing coverage can feel like a puzzle, but it’s often more straightforward than you might think. Insurance companies typically look at a combination of factors to determine if the testing is medically necessary for you. The three main areas they consider are your family’s health history, your personal health factors, and the most current clinical guidelines recommended by medical experts.

Understanding what insurers are looking for can help you and your doctor build a strong case for coverage. It’s about connecting the dots between your personal risk and the established criteria. Many people are surprised to find they meet the qualifications, especially as the guidelines for testing become more inclusive. Let’s walk through what each of these areas means for you, so you can feel confident when you start the conversation with your healthcare provider and insurance company.

Does Your Family History Meet Insurance Criteria?

One of the biggest myths is that getting insurance to cover genetic testing is always a battle. In reality, most insurance plans are quite good at covering it when there’s a clear medical reason. A significant part of that reason is your family’s health history. Insurers look for patterns of cancer across generations. They’ll want to know if close blood relatives (like your mother, sister, daughter, or even relatives on your father’s side) have had breast, ovarian, prostate, or pancreatic cancer. The age they were diagnosed also matters—a diagnosis before age 50 is a key indicator. Documenting your family health history is a powerful first step in this process.

How Your Personal Health Affects Your Eligibility

Your own health story is just as important as your family’s. Certain personal factors can automatically qualify you for coverage. For example, if you were diagnosed with breast cancer before the age of 50, have a history of triple-negative breast cancer, or have had ovarian cancer at any age, you will likely meet the criteria. A recommendation from your doctor is also a critical piece of the puzzle. Insurance plans often cover testing if a doctor recommends it, as this officially signals to your provider that the test is medically necessary for creating your treatment or prevention plan.

Understanding the Latest Clinical Guidelines for Coverage

The good news is that the criteria for who should get tested are expanding. Medical experts and organizations regularly update their recommendations based on the latest research, and insurance companies follow these guidelines. Recent clinical guidelines have broadened the criteria for BRCA counseling and testing for both women and men, meaning more people now qualify based on their family history or personal diagnosis. This reflects a growing understanding of how vital genetics are in assessing cancer risk. So, even if you or a relative didn’t qualify for testing a few years ago, it’s worth revisiting the conversation with your doctor, as you may be eligible now.

The Role of Expert Guidelines from USPSTF and ASCO

When deciding who should be tested, doctors and insurance companies don’t just guess. They rely on recommendations from major medical organizations like the U.S. Preventive Services Task Force (USPSTF), the American Society of Clinical Oncology (ASCO), and the National Comprehensive Cancer Network (NCCN). These groups are the experts who review the latest scientific evidence and establish the official guidelines. Because their recommendations are considered the standard of care, they heavily influence which services are deemed medically necessary. This is great news for you, because the Affordable Care Act (ACA) requires many insurance plans to cover preventive services—including genetic counseling and testing—when a doctor recommends it based on these expert guidelines.

How the ACA Protects Your Genetic Testing Coverage

Navigating insurance can feel overwhelming, but federal laws are in place to protect you. The Affordable Care Act (ACA) and the Genetic Information Nondiscrimination Act (GINA) established important rules that make genetic testing more accessible and prevent your genetic information from being used against you by health insurers. Understanding these protections can help you advocate for the coverage you need.

These laws set a baseline for what most health plans must cover, especially when it comes to preventive care. While coverage specifics can still vary from one plan to another, these federal regulations ensure that millions of people have a right to crucial genetic services without facing discrimination or prohibitive costs. Let’s break down what these laws mean for you.

Your Preventive Care Rights Under the ACA

The good news is that the Affordable Care Act (ACA) made preventive care a bigger priority. Thanks to this law, most health insurance plans are required to pay for BRCA genetic counseling and testing for women who have certain risk factors. This could include a personal history of breast, ovarian, or other related cancers, or a family health history that suggests a higher risk. The goal is to make these critical preventive services available without cost being a barrier, allowing you to get information that can guide your health decisions. If you think you might be at risk, this is a key provision to be aware of when you talk to your doctor and insurance company.

Special Coverage Rules If You’re High-Risk

If your personal or family history puts you in a high-risk category according to established guidelines, the ACA mandates that your insurance plan must cover the full cost of genetic counseling and BRCA testing. This means you shouldn’t have to pay a co-pay, deductible, or any other out-of-pocket fee for these specific services. However, it’s important to remember that insurance coverage rules can differ between plans. For example, Medicare has its own set of criteria and typically only covers BRCA testing for individuals who have already been diagnosed with cancer, not just those with a concerning family history. Always confirm the specifics of your own plan before moving forward.

GINA: What It Protects and Its Limitations

Beyond coverage, you might worry about how your genetic information could be used. A federal law called the Genetic Information Nondiscrimination Act (GINA) offers significant protection. Passed in 2008, GINA makes it illegal for health insurance companies to use your genetic test results to deny you coverage, charge you higher premiums, or treat your genetic makeup as a pre-existing condition. However, GINA has its limits. The law does not apply to life insurance, disability insurance, or long-term care insurance. This means that a personal or family history of cancer, revealed through testing or not, could still impact your eligibility or rates for these other types of policies.

How HIPAA Also Protects Your Genetic Information

GINA isn’t the only law on your side. The Health Insurance Portability and Accountability Act (HIPAA) also protects genetic information, adding another layer of security, especially when it comes to group health plans. Under HIPAA, these plans are prohibited from using your genetic details to raise your premiums or deny you enrollment. It also prevents them from treating your genetic predisposition as a pre-existing condition, ensuring that your genetic makeup can’t be used to limit your access to health coverage. This means you can pursue genetic testing without worrying that the results will jeopardize the health insurance you get through your job, giving you greater peace of mind as you take proactive steps for your health.

Key Gaps in GINA’s Protections

While GINA provides a strong foundation of protection, it’s smart to know where its coverage ends. The law does not apply to life insurance, disability insurance, or long-term care insurance. This means a personal or family history of cancer, whether confirmed by genetic testing or not, could still be used by these insurers to determine your rates or eligibility. GINA also doesn’t apply to employers with fewer than 15 employees. Most importantly, it protects against discrimination based on your genetic risk for a *future* health issue, but it does not protect you if you already have a cancer diagnosis. Understanding these limitations helps you make fully informed decisions about your health and financial planning.

What Will a BRCA Test *Actually* Cost With Insurance?

Figuring out the cost of genetic testing can feel like solving a puzzle, especially when you’re already managing so much. Even when your insurance company says a test is “covered,” that doesn’t always mean it’s free. The reality is that you might still have out-of-pocket expenses to plan for, and the final price tag depends on your specific insurance plan, the type of test you get, and whether you’ve met your annual deductible. Understanding these potential costs ahead of time can help you make informed decisions without any financial surprises.

Think of it this way: “coverage” means your insurance plan agrees that the test is medically necessary and will contribute to the cost according to your plan’s rules. But your share of that cost can vary quite a bit. Let’s walk through the key terms you’ll encounter so you can feel confident when discussing costs with your provider and your insurance company.

Your Guide to Co-Pays, Deductibles, and Co-Insurance

Even if a test is covered, you might still be responsible for a portion of the bill. Your share of the cost typically comes in one of three forms. A co-pay is a simple flat fee you pay for a service, like $25 for a doctor’s visit. Your deductible is the amount you need to pay for your healthcare each year before your insurance plan starts to help with the costs. This can range from a few hundred to several thousand dollars. Once you’ve met your deductible, co-insurance kicks in. This is the percentage of the cost you’ll share with your insurance company—for example, they might pay 80%, leaving you to cover the remaining 20%.

Why Does BRCA Test Insurance Coverage Vary?

Unfortunately, there’s no single rulebook for how insurance plans cover genetic testing; every provider has its own set of guidelines. For example, Medicare often covers BRCA testing for people who have already been diagnosed with cancer, but not always for those who only have a family history. Medicaid coverage can also vary significantly from one state to another. Because these insurance coverage rules differ so much, it’s essential to check the details of your own policy. This is the best way to get a clear picture of what to expect financially instead of making assumptions based on someone else’s experience.

Differences in Insurance Coverage by Plan Type

The type of insurance plan you have is one of the biggest factors in determining your coverage for genetic testing. While federal laws like the ACA set a baseline, the specific rules can look very different depending on whether you have a private plan, Medicare, or Medicaid. Understanding these distinctions is key to knowing what to expect and how to prepare for conversations with your healthcare provider. Each system has its own criteria for what it considers medically necessary, which directly impacts your eligibility and potential out-of-pocket costs. Let’s break down some of the key differences you might encounter.

Medicare Limitations for Screening

If you have Medicare, it’s important to know that its rules for genetic testing are often more restrictive than those of private insurers. Generally, Medicare requires a personal history of cancer for you to be eligible for coverage. This means that having a strong family history of breast or ovarian cancer, which might qualify you for testing under a private plan, may not be enough on its own to meet Medicare’s criteria. The focus is typically on using the test results to guide treatment for an existing diagnosis rather than for preventive screening in individuals who have not had cancer themselves. This is a critical distinction to be aware of when discussing your options with your doctor.

Medicaid Coverage Inconsistencies by State

Because Medicaid is administered at the state level, there is no single national policy for genetic testing coverage. The rules can vary dramatically depending on where you live. For example, past reviews have shown that some state Medicaid programs may not cover BRCA testing for cancer risk at all, while others do but may have unclear eligibility requirements. This inconsistency means you can’t assume that what’s covered in one state will be covered in another. The most important step is to research your specific state’s Medicaid policies or work with a genetic counselor who can help you find the most current information for your area.

Coverage for Follow-Up MRI Screenings

Getting a genetic test is often just the first step. If your results show you have a high-risk mutation like BRCA1 or BRCA2, your doctor will likely recommend a more intensive screening plan, which could include regular breast MRIs. Private insurance companies often have clear policies for covering these follow-up screenings, frequently aligning with expert recommendations like the NCCN Guidelines®. However, public insurance programs like Medicare and Medicaid may not have such specific or clearly defined policies for MRI surveillance. This can create uncertainty, making it crucial to ask not only about coverage for the genetic test itself but also about coverage for the long-term screening and prevention plan that might follow.

Getting Pre-Authorization: A Necessary First Step

Getting pre-authorization from your insurance company is one of the most important steps you can take to avoid a surprise bill. Think of it as getting a green light from your insurer before the test, confirming it’s medically necessary and will be covered under your plan. A genetic counselor can be an incredible resource in this process. They can help you understand the potential costs and determine which test is right for you. When you or your counselor speak with your insurance provider, be direct. Ask specifically about coverage for both genetic counseling and testing (like BRCA or multi-gene panels) and confirm if pre-authorization is required to move forward.

How to Get Your BRCA Test Approved by Insurance

Getting approval for genetic testing can feel like one more hurdle in an already overwhelming process, but you can absolutely handle it. The key is to be proactive and prepared. By understanding your insurance plan, knowing what to ask, and leaning on the right experts for support, you can confidently work toward getting the coverage you need. Let’s walk through the steps together.

A Checklist for Verifying Your Benefits

Before your doctor even orders the test, take some time to investigate your insurance plan. The best place to start is by calling the member services number on the back of your insurance card or logging into your provider’s online portal. Every plan is different, so you’ll want to check the specific details of your policy to understand what’s covered and what your potential out-of-pocket costs might be. Look for documents called the “Summary of Benefits and Coverage” or the “Evidence of Coverage.” These will outline what your plan pays for preventive services and genetic testing, helping you avoid any surprise bills down the road.

Scripts for Talking to Your Insurance Company

When you call your insurance company, being prepared with specific questions can make the conversation much more productive. Start by asking if they cover genetic counseling and testing for hereditary breast cancer. Many plans will cover these services if your doctor recommends them based on your personal or family health history. You can ask questions like, “What are the specific medical criteria for covering BRCA1 and BRCA2 testing?” and “Do I need a pre-authorization before I get the test?” Be sure to take notes during the call, including the date, the representative’s name, and a reference number for your conversation. This helps you keep track of the information they need from your doctor’s office.

Why a Genetic Counselor Is Your Best Advocate

You don’t have to do this alone. A genetic counselor can be your best advocate in this process. These specialists are experts in both genetics and insurance coverage, acting as a liaison between you, your doctor, and the insurance company. They can help determine the most appropriate test for you and can often handle the pre-authorization process directly. They will work with your doctor to provide the necessary documentation to prove medical necessity. A counselor also plays a vital role in helping you understand your test results and what they mean for you and your family, making them an invaluable part of your care team.

What About At-Home Genetic Tests?

With the rise of direct-to-consumer genetic testing, it’s tempting to order a kit online and get answers from the comfort of your home. These tests are marketed as an easy, affordable way to learn about your ancestry and health risks. While they can be a fun tool for exploring your background, they are not a substitute for clinical genetic testing ordered by your doctor. When it comes to your health, especially your cancer risk, the information you get from at-home kits can be incomplete or even misleading. Before you add one to your cart, it’s crucial to understand their limitations and why the medical community advises caution.

Potential for Inaccuracies and Errors

Direct-to-consumer tests allow you to access genetic information without involving a doctor or your insurance company, but this convenience comes at a cost. These tests can have errors and may not screen for all the important mutations linked to breast cancer. For example, a popular at-home test might only look for the three most common BRCA mutations found in people of Ashkenazi Jewish descent, while a clinical test would analyze the entire BRCA1 and BRCA2 genes for thousands of possible mutations. This means an at-home test could give you a false sense of security, missing a significant mutation that a more comprehensive medical test would have caught. Your personal information might also not be as secure as it would be in a medical setting.

Lack of Insurance Coverage for At-Home Kits

One of the most straightforward differences between at-home and clinical testing is the cost structure. Insurance plans do not cover direct-to-consumer genetic testing kits. Insurers cover services that are deemed medically necessary and ordered by a healthcare provider to diagnose or treat a condition. Because at-home tests are purchased directly by you without a doctor’s order, they fall outside of what insurance considers medical care. While the upfront cost of a kit might seem lower than a clinical test, remember that insurance often covers the full cost of medically necessary testing for high-risk individuals, making the clinical route the more financially sound option for those who qualify.

Why Medical Confirmation is Recommended

If you use an at-home test and it indicates you have a gene mutation, your journey isn’t over—it’s just beginning. These results are not considered a medical diagnosis. Your next step should always be to make an appointment with a doctor or genetic counselor. They will almost certainly recommend that you get re-tested in a certified clinical laboratory to confirm the findings. A medical professional can ensure the right test is ordered and, more importantly, help you understand what the results truly mean for your health and your family. Without that expert guidance, you’re left with a piece of information that can be confusing or alarming, but not actionable.

What’s Changing in Genetic Testing Coverage?

The world of genetic testing is always evolving, and that’s great news for patients. New technologies, updated insurance policies, and more accessible financial support are making it easier to get the tests you need. Staying informed about these changes can help you build a stronger case for coverage and find resources to manage costs. Understanding these advancements empowers you to have more productive conversations with your doctor, genetic counselor, and insurance provider about what’s possible for your care.

How AI Is Changing Coverage Criteria

New technology is helping doctors identify people who could benefit from genetic testing more accurately than ever before. Specifically, the integration of AI screening tools into routine care is a game-changer. These smart systems can analyze health records to spot risk factors for mutations like BRCA1 and BRCA2 that might otherwise be missed. If an AI tool flags you as being at higher risk, it provides concrete data that can strengthen your doctor’s recommendation for testing. This can be a powerful piece of evidence to share with your insurance company when seeking pre-authorization, as it adds a layer of clinical validation to your request.

Staying on Top of Insurance Policy Updates

As clinical guidelines for genetic testing expand, many insurance companies are updating their coverage policies to keep pace. This means that even if you were told you didn’t qualify for testing in the past, you might be eligible now. Updated recommendations from medical organizations, combined with a better understanding of genetics, have led to improved insurance coverage that makes testing more common and comprehensive. It’s always a good idea to re-check your insurer’s latest medical policy for genetic testing or ask your doctor if recent guideline changes might affect your eligibility. Don’t assume a past denial is the final word.

Financial Aid Options When Insurance Says No

Even with insurance, out-of-pocket costs can be a real barrier. Studies show that cost-sharing keeps some people from getting recommended tests, highlighting the need for financial assistance options. If your insurance plan has a high deductible or co-pay, don’t get discouraged. Many genetic testing companies offer their own financial assistance programs or flexible payment plans. You can also look for support from non-profit organizations dedicated to cancer care. Your hospital’s financial navigator or social worker is another excellent resource who can help you find programs you may qualify for.

Typical Self-Pay Costs for Genetic Testing

If your insurance doesn’t cover genetic testing or if you have a high deductible, you’ll want to know the self-pay price. Don’t let the sticker shock stop you before you even start—the cost has come down significantly over the years. If you’re paying out of pocket, a BRCA test can start at around $250, but the final price varies by lab and the complexity of the test. A multi-gene panel that looks for mutations beyond BRCA1 and BRCA2 will naturally cost more than a test for a single gene. It’s always a good idea to call the lab directly to ask for their self-pay or cash price, as it can sometimes be lower than the rate negotiated with insurance companies.

Finding Additional Financial Assistance

If the out-of-pocket cost is still a concern, you have several places to turn for help. Many of the major genetic testing labs have their own patient assistance programs that can significantly reduce or even eliminate the cost for eligible individuals. Your first step should be to ask your genetic counselor or the lab itself about these programs. Additionally, many hospitals and cancer centers have charity funds or patient navigator services that can connect you with financial aid. Non-profit organizations dedicated to breast cancer support are another excellent resource, as they often provide grants to help cover the costs of care, including genetic testing.

Related Articles

- Should You Get Genetic Testing for Breast Cancer?

- Should You Get Genetic Testing for Breast Cancer?

- BRCA Testing Cost: A Complete Guide for 2025

- Genetic testing for breast cancer risk (Cost & accuracy) | Outcomes4me

View your personalized treatment plan in the Outcomes4Me app

Use your diagnosis to unlock personalized NCCN Guidelines®-aligned recommendations.

Frequently Asked Questions

What if I don’t know my family’s health history? It’s very common to have gaps in your family health history, especially if you were adopted or are not in contact with your relatives. In this case, your personal health factors become even more important. Your doctor will focus on details like your age at diagnosis if you’ve had cancer, the specific type of cancer, and your ancestry. Be sure to share this with your healthcare provider, as these factors alone can often meet the criteria for insurance to cover genetic testing.

Does a positive result from a BRCA test mean I’m going to get cancer? No, it absolutely does not mean you will definitely get cancer. A positive result indicates that you have a significantly higher risk compared to someone without the mutation. Think of it as valuable information that empowers you to be proactive. This knowledge allows you and your doctor to create a personalized screening plan, discuss risk-reducing medications, or consider preventive surgeries. It’s about managing your risk, not predicting your future.

My insurance denied coverage for genetic testing. What should I do now? A denial can be frustrating, but it isn’t always the final answer. First, work with your doctor or genetic counselor to understand the specific reason for the denial. Sometimes, it’s a simple issue of needing more documentation to prove medical necessity. You have the right to appeal the decision, and a genetic counselor can be a huge help in navigating that process. You can also explore financial assistance programs offered by testing labs or non-profit organizations, which can make testing more affordable.

Will my genetic test results affect my relatives’ ability to get health insurance? Thanks to a federal law called GINA (Genetic Information Nondiscrimination Act), your health insurer cannot use your genetic test results—or your relatives’ results—to determine your eligibility or set your premiums. Your genetic information is protected. However, it’s important to know that GINA’s protections do not extend to life, disability, or long-term care insurance.

I was tested for BRCA mutations years ago. Should I consider being tested again? This is a great question, and the answer might be yes. Genetic testing technology has advanced significantly. Older tests often only looked for mutations in the BRCA1 and BRCA2 genes. Today, it’s common to use multi-gene panels that test for mutations in many different cancer-risk genes at once. If your last test was more than a few years ago, it’s worth talking to your doctor or a genetic counselor to see if updated testing could provide you with more complete information.