Estate planning for cancer patients explained

August is National Make-A-Will Month, and in recognition of this important awareness month, Outcomes4Me is sharing related, helpful resources with our patient members.

While estate planning might sound fanciful or grand, it’s an essential task for everyone of all ages, incomes, and with all types of assets.

First things first: what’s an estate? Essentially, it’s everything an individual owns. All of these items are included in an estate: your car, your home if you own one, any other real estate, your bank accounts, any investments, insurance policies, furniture, and any other personal possessions (like your clothes!). If you have any pets, even though you likely consider them family, the law in your state likely views your pets as your property, and thus part of your estate.

Everyone has an estate, and another commonality: when we die, our estate lives on. That’s why it’s important to document who we want to inherit what we leave behind. As a cancer patient, mortality is already top-of-mind, and planning for when we’re no longer here is likely not our top priority. But, it’s important to document your wishes for both your care and your assets for now and in the future so you remain in control of what happens to what’s most important to you.

Here are the steps you need to take to complete estate planning:

- Document your wishes for both your own care and your financial affairs:

- Complete an advance directive: this is a legal document that will outline how you want your healthcare to be managed should you at some point become incapacitated and unable to voice your own preferences.

- A living will is part of the directive, and puts into writing the medical treatments you would(or wouldn’t) want to receive if you were near the end of your life. A healthcare power of attorney–also known as a healthcare proxy–allows you to designate someone who can make medical decisions for you if you can’t make them yourself.

- A financial durable power of attorney designates someone who can make financial decisions on your behalf if you’re unable to voice those decisions yourself.

- Draft a last will & testament: this legal document is where you can outline what you want to happen to your possessions and assets, as well as where you can outline care for any dependents (e.g. children or elderly loved ones). Within your will, you’ll nominate an executor of your estate who will ultimately be responsible for following through on the wishes outlined in your will.

None of us want to think about no longer being here, surrounded by the ones we love. But spending the time now to document wishes ensures that our own preferences are upheld and those most important to us are cared for. Each state has different policies, but if a person passes without a will, then the government steps in to make decisions. Take the steps now to ensure that doesn’t happen.

To coincide with National Make-A-Will Month, Outcomes4Me has teamed up with Trust & Will to offer our members a 20% discount on estate planning offerings. Use this link to receive your discounted estate planning services.

This post contains affiliate links. If you click on one of these links and make a purchase, we may receive a commission.

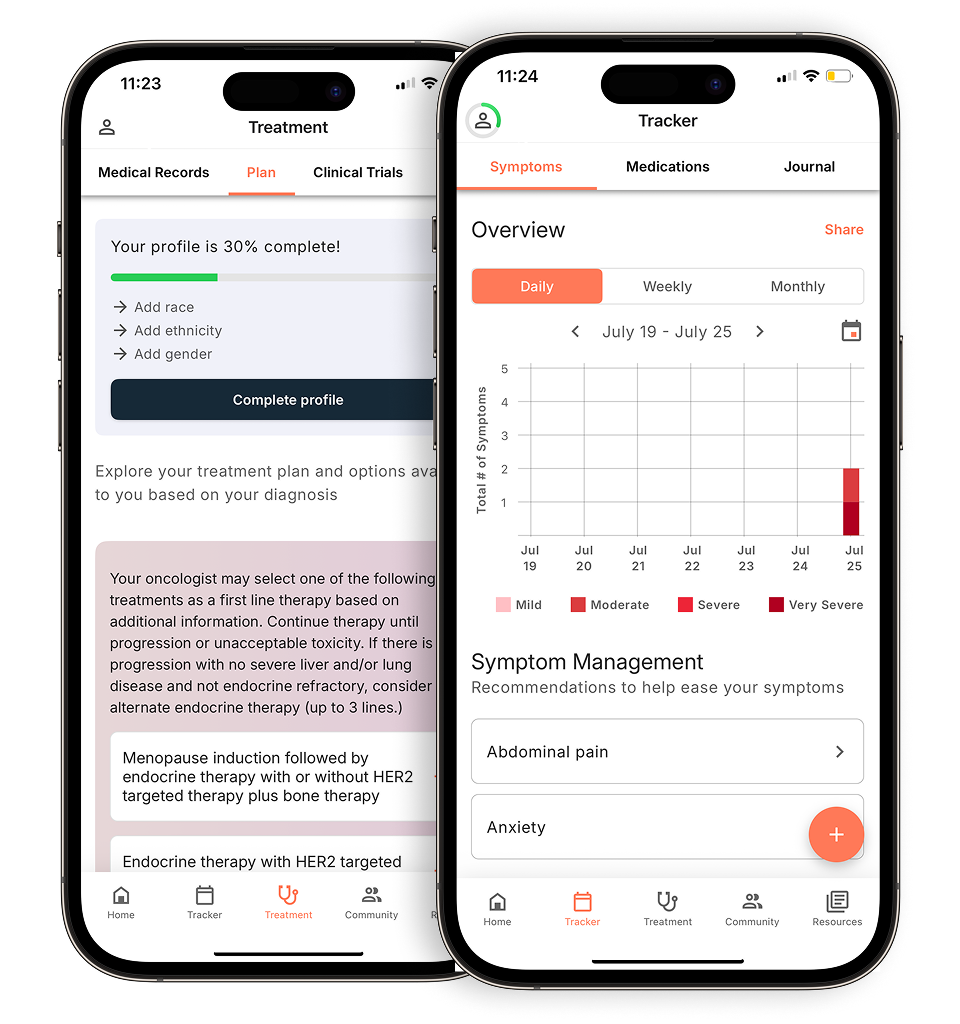

Personalized support for real care decisions

Understand your diagnosis, explore clinical trials, and track symptoms--all in one place.

Get started

Compare treatments, prepare for appointments, and track side effects—all in the app

Built for your diagnosis, Outcomes4Me gives you the tools to make confident, informed decisions—right when you need them.

Continue in app