Misconceptions about wills for cancer patients

August is National Make-A-Will Month, and in recognition of this important awareness month, Outcomes4Me is sharing related, helpful resources with our patient members.

There are a lot of unknowns when it comes to creating a will, leading to some misconceptions surrounding estate planning. In fact, only 32% of Americans have a will. The truth is, most of us don’t want to think about this step until it’s necessary. However, planning ahead is an important step for peace of mind to ensure your wishes will be followed, regardless of your current health status or age.

In this blog, we address some common myths you may have heard about wills.

1) It’s bad luck to create a will

One of the top misconceptions about wills is that it’s “bad luck.” Many people believe that making a will somehow invites misfortune and manifests negativity. In reality, creating a will provides clarity and peace of mind by knowing that your affairs will be handled the way you want. By planning ahead, you can also alleviate the burden on your loved ones.

2) My spouse will automatically inherit my assets so I don’t need to make a will

Another common belief is that your spouse will automatically inherit everything after passing. Without a will, however, the state will divide your assets according to its own intestate process which may not align with your desires and become overwhelming for family members.

3) I don’t have enough assets to include in a will

A will is not just about financial assets. It addresses personal items, sentimental belongings, and digital assets, and even provides guidance for the care of pets. Especially in today’s digital age, your will can include instructions for managing your online presence, such as social media accounts, digital photos, and more.

4) I don’t have children so I don’t need a will

A will can designate beneficiaries for your assets even if you don’t have children. If you have close friends, extended family, or charities that are important to you, you can include them in your will.

5) I don’t have the time to think about a will

If you’re navigating a serious illness, such as cancer, it can be understandably hard to find the time and mental capacity to even think about a will. Creating a will doesn’t have to happen in one sitting, you can break down the process into slower steps and start with a basic outline.

Aligning with National Make-A-Will Month, Outcomes4Me has partnered with Trust & Will, an online resource that breaks down the steps of creating and updating a will in one place. Through this collaboration, members can take 20% off estate planning offerings. Use this link to receive your discounted estate planning services.

This post contains affiliate links. If you click on one of these links and make a purchase, we may receive a commission.

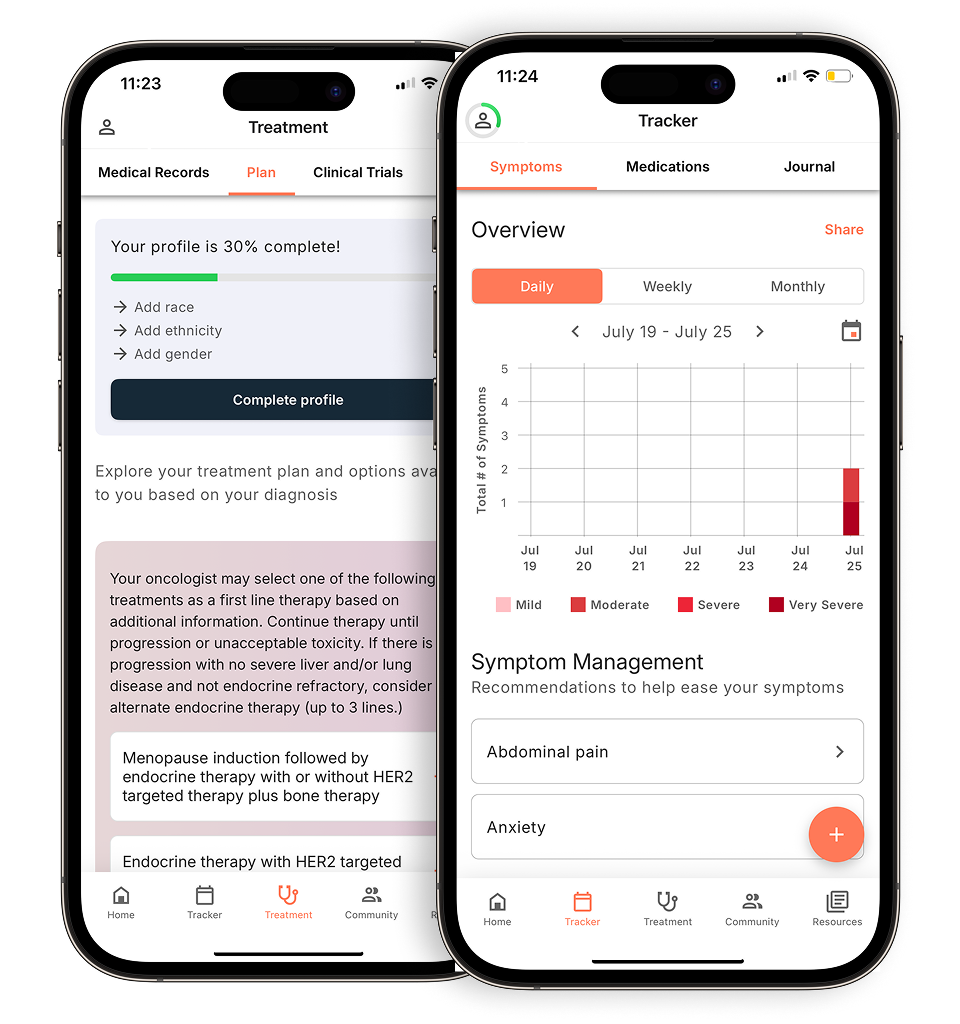

Personalized support for real care decisions

Understand your diagnosis, explore clinical trials, and track symptoms--all in one place.

Get started

Compare treatments, prepare for appointments, and track side effects—all in the app

Built for your diagnosis, Outcomes4Me gives you the tools to make confident, informed decisions—right when you need them.

Continue in app