How to make a will if you have cancer

August is National Make-A-Will Month, and in recognition of this important awareness month, Outcomes4Me is sharing related, helpful resources with our patient members.

Creating a will may be the last thing on your mind, especially if you’re navigating a cancer diagnosis and treatment. We sometimes hear from patients that there’s trepidation around estate planning. Some worry that estate planning and drafting a will are “bad luck,” but these are important processes that everyone, regardless of age and health status, can benefit from. By having a clear plan, you can ensure that your wishes will be followed and ease the stress and burden for loved ones.

In this blog, we’ll discuss the difference between estate planning and wills and break down the steps of creating a will.

What’s the difference between estate planning and wills?

It’s often assumed that estate planning and wills are the same thing, but a will is only one part of estate planning. However, a will is a large component of estate planning and takes into account how you’d like to divide your assets and possessions. If you have dependents or elderly parents, your will can also include the ongoing care and custody of loved ones.

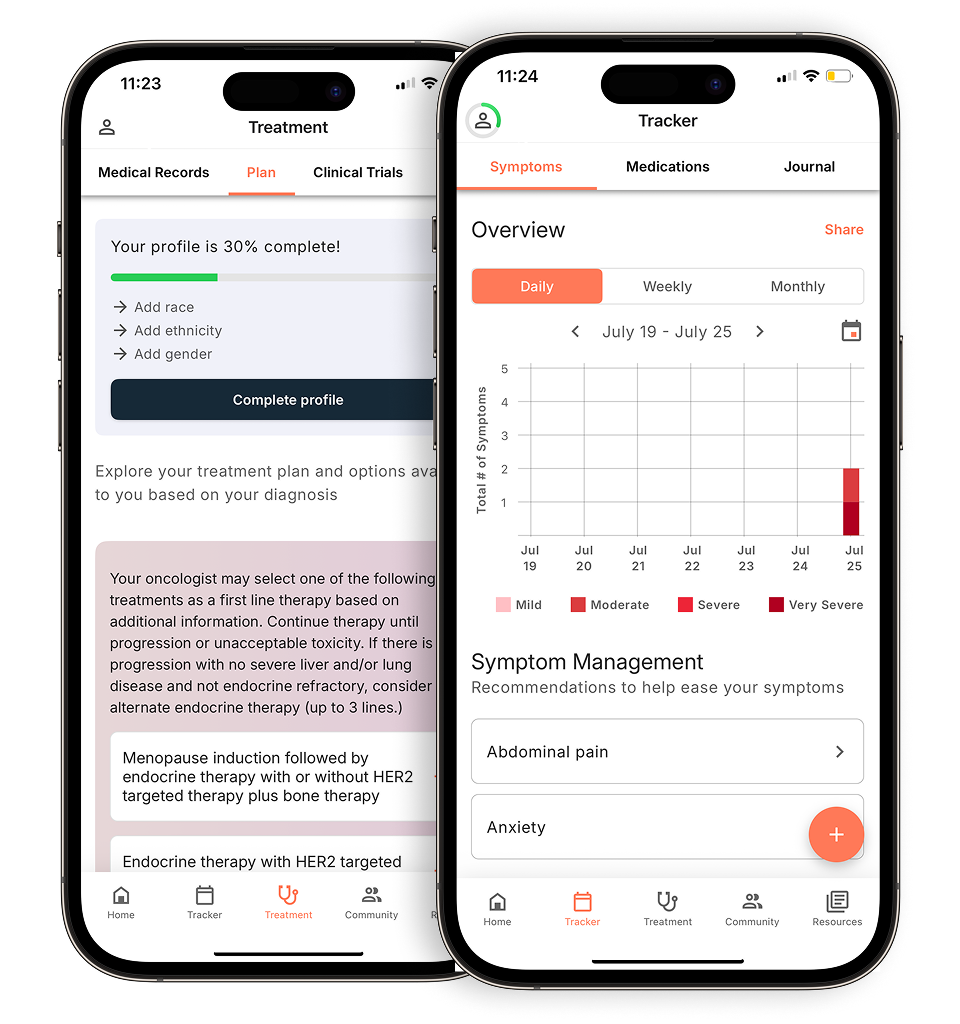

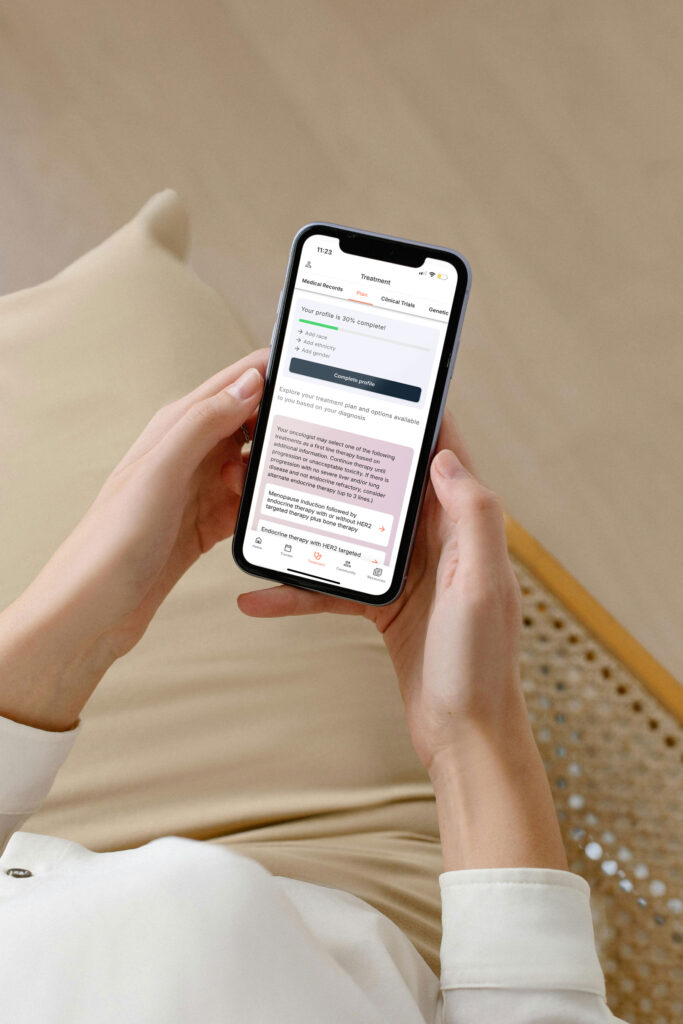

Evidence-based guidance powered by NCCN Guidelines®

Personalized treatment plans shaped by the latest oncology standards—tailored to your diagnosis.

Get started

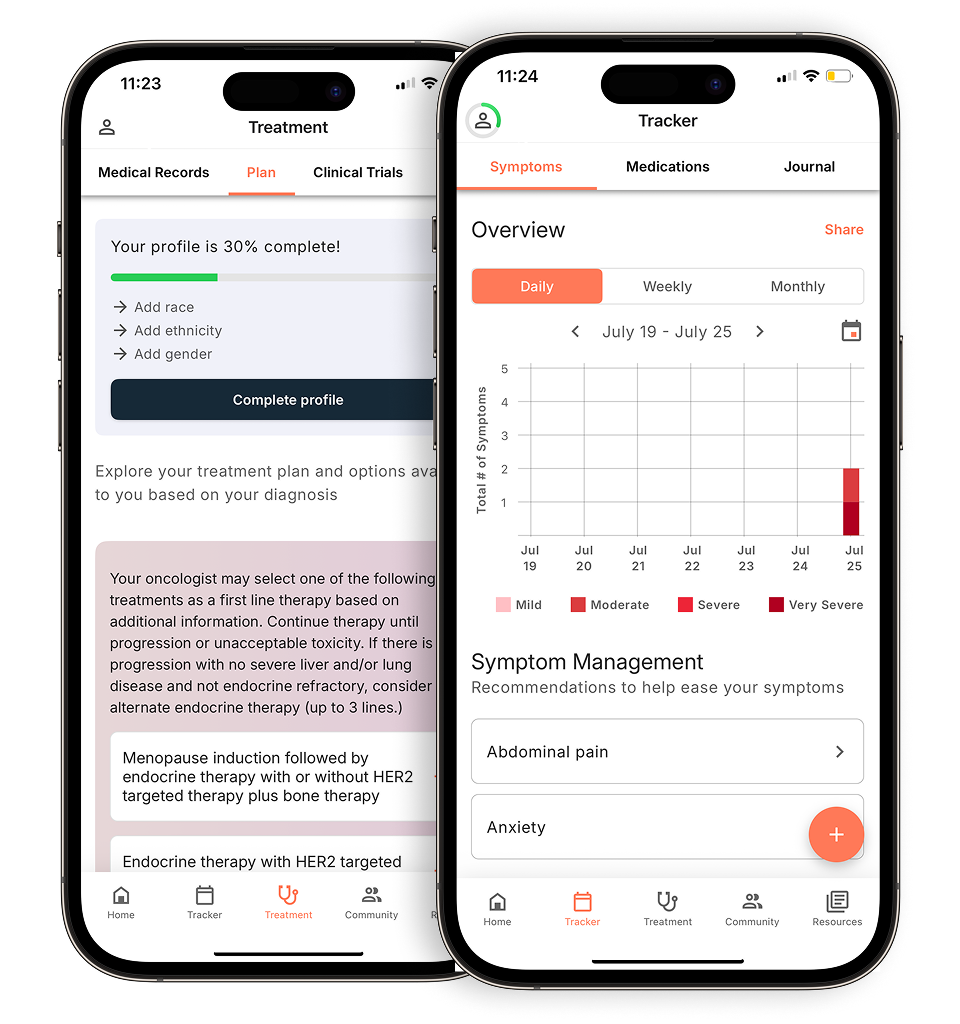

View your personalized treatment plan in the Outcomes4Me app

Use your diagnosis to unlock personalized NCCN Guidelines®-aligned recommendations.

Continue in app

Steps to take to create a will

1) Review your assets and final wishes

The first step is to take inventory of your assets including real estate, bank accounts, investments, and personal property. You should also include any collectibles you may have like cars, jewelry, artwork, or even sentimental objects. Digital assets (emails, social media accounts, electronic platforms) are another component to consider.

2) Gather documents needed

Once you’ve reviewed your assets, compile the necessary documents that reflect your assets. This includes deeds, titles, insurance policies, bank statements, investment account information, and any other relevant paperwork. Having these documents organized and readily available will streamline the process of detailing your estate in your will.

3) Choose your executor and beneficiaries

An executor is responsible for carrying out the instructions in your will. Choose someone you trust to handle this responsibility, as this person will manage your estate, distribute assets according to your wishes, and be the main point of contact.

You’ll also want to decide who will receive your assets. Beneficiaries can include family members, friends, charities, or other organizations. Be specific in naming individuals and what they are to receive to avoid any confusion or disputes.

4) Appoint guardians for minor children

If you have minor children, adult dependents, or even pets, it’s essential to think through who you want to list as their guardians. This is a deeply personal decision that can be the most difficult part of creating a will, albeit an important one.

Discuss your choice with the potential guardians to ensure they feel comfortable and prepared to take on this role.

5) Finalize and store your will

To write your will, you can reach out to an attorney or use a service like Trust & Will to manage and simplify all aspects of estate planning in one place. This is a good option if you need to create powers of attorney, trusts, a letter of intent, or other documents.

After your will is written, check your state mandates on what is necessary to finalize the will. Things like witnesses and notaries can vary from state to state, so be sure to review your own state’s requirements.

Once your will is completed, the final step to consider is storage for your will. This can be a safety deposit box, a safe, or with someone you trust.

Updating and amending your will

As life changes and evolves, so might your wishes. Review your will periodically, especially after significant life events such as marriage, divorce, or the birth of a child or grandchild. Updating your will ensures that it remains aligned with your wishes.

Although creating a will has challenging aspects, it’s a key tool that offers clarity and peace of mind not only for yourself but for loved ones too.

To coincide with National Make-A-Will Month, we’ve partnered with Trust & Will, a guided online platform that helps create and update your will. Through this collaboration, our members can take 20% off estate planning offerings. Use this link to receive your discounted estate planning services.

This post contains affiliate links. If you click on one of these links and make a purchase, we may receive a commission.

Personalized support for real care decisions

Understand your diagnosis, explore clinical trials, and track symptoms--all in one place.

Get started

Compare treatments, prepare for appointments, and track side effects—all in the app

Built for your diagnosis, Outcomes4Me gives you the tools to make confident, informed decisions—right when you need them.

Continue in app