Learning the language of health insurance can feel like a full-time job, with terms like “deductible,” “pre-authorization,” and “in-network” creating a lot of confusion. When you’re considering a vital service like genetic testing, you need clear answers, not more jargon. The central question for many is, does insurance cover genetic testing for breast cancer? While coverage is common, the rules vary between private insurance, Medicare, and Medicaid. We’re here to translate the fine print for you, explaining what you can expect to pay and how to work with your doctor to build a strong case for getting your test covered.

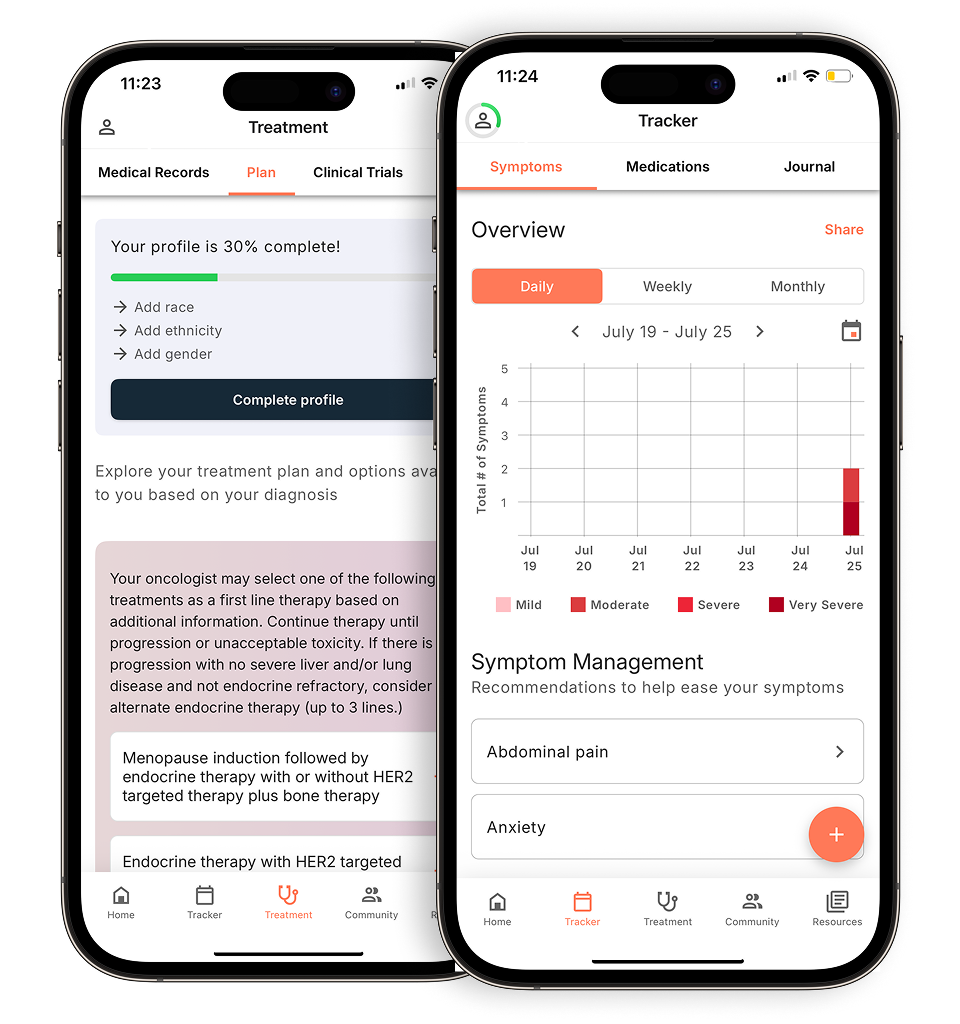

View your personalized treatment plan in the Outcomes4Me app

Use your diagnosis to unlock personalized NCCN Guidelines®-aligned recommendations.

Key Takeaways

- Genetic testing gives you actionable health information: Finding a gene mutation doesn’t mean you have cancer; it means you can work with your doctor to create a personalized screening and prevention plan based on your specific risk.

- Insurance coverage hinges on medical need: Most insurance plans will cover testing if your personal or family health history meets their specific criteria. Laws like the ACA and GINA offer financial and privacy protections, but approval isn’t automatic.

- A proactive approach is key to getting covered: Partner with your doctor and a genetic counselor to get pre-authorization from your insurer before the test. Understanding your plan’s specific costs and using in-network labs will help you avoid unexpected bills.

What Is Genetic Testing for Breast Cancer?

Genetic testing for breast cancer is a process that looks for specific, inherited changes (mutations) in your genes that could increase your risk of developing the disease. Think of your genes as the instruction manual for your body; genetic testing reads certain pages of that manual to see if there are any typos that might cause problems down the line. It’s important to remember that finding a mutation doesn’t mean you have cancer or will definitely get it. Instead, it provides you and your doctor with crucial information, allowing you to be proactive about your health and create a screening plan that’s tailored specifically to you.

What Are BRCA1 and BRCA2 Gene Mutations?

You’ve probably heard about the BRCA1 and BRCA2 genes. These are two of the most common genes linked to hereditary breast cancer. In a healthy state, these genes act as tumor suppressors, helping to repair DNA damage and keep cell growth in check. When a harmful mutation exists in one of these genes, they can’t perform their job correctly. This is why having a BRCA gene mutation raises a person’s lifetime risk of developing breast, ovarian, prostate, and pancreatic cancers. Since these mutations are inherited, knowing your status can be an important piece of your family’s health puzzle.

Should You Consider Genetic Testing?

Deciding to get tested is a very personal choice, and it’s best made in conversation with your doctor or a genetic counselor. Testing is often recommended if certain types of cancer appear in your family tree. Your doctor might suggest it if you have a personal or family history of breast cancer diagnosed before age 50, ovarian cancer at any age, or cancer in multiple relatives. The best first step is to gather your family health history and discuss it with your provider. They can help you weigh the pros and cons and determine if testing is a good option for you.

How Genetic Testing Can Help You

The greatest benefit of genetic testing is the knowledge it provides. If your results show you have an increased genetic risk, you are empowered to take action. This information allows you and your doctor to create a personalized plan to manage that risk. This could involve starting screenings like mammograms or MRIs at an earlier age, having them more frequently, or discussing risk-reducing options like medications or preventive surgery. It’s about using your unique genetic information to make informed, proactive decisions that put you in the driver’s seat of your health journey.

Does Insurance Cover Genetic Testing?

The question of whether insurance will cover genetic testing is a big one, and thankfully, the answer is often yes. Many health insurance plans do cover genetic testing for hereditary cancer risk, but coverage isn’t automatic. It usually depends on your specific insurance plan, your personal medical history, and your family’s health history. Understanding the landscape can help you feel more prepared as you take this step.

Navigating insurance can feel like learning a new language, but a few key pieces of legislation and common practices are on your side. The Affordable Care Act (ACA) made preventive care, including certain genetic tests, more accessible. At the same time, a federal law called the Genetic Information Nondiscrimination Act (GINA) offers important protections against discrimination based on your genetic information. Beyond these laws, each insurance company has its own set of rules for what it will cover and what you might need to pay out-of-pocket. Knowing about these factors ahead of time can make the process much smoother.

How the ACA Affects Your Coverage

The Affordable Care Act (ACA) has made a significant difference for many people seeking genetic testing. Under the law, most health plans are required to cover certain preventive services without charging you a co-pay or co-insurance, even if you haven’t met your yearly deductible. For women who meet specific criteria related to their personal or family cancer history, this mandate includes genetic counseling and BRCA1/BRCA2 testing. If your doctor determines that testing is medically necessary for you based on these risk factors, the ACA helps ensure that cost isn’t a barrier to getting the information you need for your health.

Your Legal Protections Under GINA

It’s completely normal to wonder what happens to your genetic information after you get tested. The Genetic Information Nondiscrimination Act (GINA) is a federal law designed to protect you. GINA makes it illegal for health insurance companies to use your genetic information to make decisions about your eligibility or coverage. It also prevents employers from using your genetic data to make decisions about hiring, firing, or promotions. It’s important to know, however, that GINA’s protections do not extend to life insurance, disability insurance, or long-term care insurance policies.

Common Coverage Requirements and Limits

Even with the ACA and GINA in place, most insurance companies have specific criteria you must meet to get genetic testing covered. These guidelines are often based on recommendations from medical organizations and typically involve having a personal or family history of certain cancers. It’s also important to understand that “covered” doesn’t always mean 100% free. You may still be responsible for some out-of-pocket costs, such as a co-pay (a flat fee for the service), a deductible (the amount you pay before your insurance kicks in), or co-insurance (a percentage of the cost you share with your insurer).

What Do Insurance Companies Look For?

When deciding whether to cover genetic testing, insurance companies are trying to determine if it’s “medically necessary” for you. They use a specific set of criteria to make this call, which is usually based on national guidelines from organizations like the National Comprehensive Cancer Network (NCCN). Understanding what they look for can help you and your doctor prepare the information needed to get your test approved. Insurers typically focus on three key areas: your medical history, specific risk factors, and whether you’ve completed the required preliminary steps.

Your Personal and Family Medical History

Your health story is the most important factor. Insurers look for clear patterns that suggest a hereditary risk for cancer. Most private health insurance plans will cover genetic testing if you have a personal history of cancer or a family history of cancer that meets established guidelines. This could mean having multiple relatives on the same side of the family with breast or ovarian cancer, a relative diagnosed at a very young age, or a personal or family history of male breast cancer. Gathering these details about your family’s health is a great first step in the process.

Age and Other Risk Factors

Specific details about your family’s health history matter, especially the age of diagnosis. Your doctor might suggest the test if you or your family have a history of breast, ovarian, prostate, or pancreatic cancer, particularly if breast cancer was diagnosed before age 50. Other red flags for insurers include a personal or family history of two separate cancer diagnoses or being of Ashkenazi Jewish descent, which is associated with a higher prevalence of BRCA mutations. These factors help your care team demonstrate a medical need for the test.

The Role of Pre-Authorization and Genetic Counseling

Before you get tested, your insurance company will likely require a pre-authorization, which is essentially their official approval for coverage. As part of this process, many insurers also require that you speak with a genetic counselor. It’s helpful to see this not as a hurdle, but as a valuable resource. A genetic counselor is an expert who can review your family health history, discuss the emotional and medical implications of testing, and help you make an informed decision. Some insurers require you to have genetic counseling before they will agree to pay for the test itself.

Genetic Testing Coverage: Private Insurance vs. Medicare vs. Medicaid

Understanding how your insurance plan handles genetic testing can feel like a job in itself. Coverage varies quite a bit depending on whether you have a private plan, Medicare, or Medicaid. Each has its own set of rules and eligibility requirements, but the good news is that coverage is often available, especially if you meet certain criteria related to your personal or family health history. Let’s walk through what you can generally expect from each type of insurance so you can feel more prepared when you have these conversations with your doctor and insurance provider.

What to Expect from Private Insurance

If you have a private health insurance plan, it will likely cover genetic counseling and testing, provided you meet specific guidelines. These rules usually revolve around your personal or family history of cancer. You might still have some out-of-pocket costs, like deductibles or copays, so it’s always a good idea to check your plan details. Under the Affordable Care Act (ACA), most private insurance companies are required to cover BRCA1 and BRCA2 testing with no out-of-pocket costs for women who meet certain criteria. This typically applies if you have a personal or family history of breast, ovarian, or related cancers and use an in-network provider.

Medicare: Eligibility and Limitations

Medicare’s rules for genetic testing are a bit more specific. Generally, Medicare covers genetic testing only if you have already been diagnosed with cancer and your personal or family history meets their criteria. For example, Medicare may cover BRCA testing if you have certain types of cancer, such as ovarian, pancreatic, specific breast cancers (including male breast cancer), or some prostate cancers. Coverage may also be approved if a close family member has a known BRCA mutation and you have a related cancer diagnosis. It’s important to work with your doctor to confirm if your specific situation qualifies for coverage under Medicare.

Medicaid: How Coverage Varies by State

Coverage for genetic testing through Medicaid is determined at the state level, which means the rules can differ depending on where you live. The great news is that nearly every state’s Medicaid program covers BRCA genetic testing for individuals who qualify. Eligibility is typically based on having a known genetic mutation in your family or a personal or family history of cancer that meets the state’s guidelines. However, some states may only cover testing for people who already have a cancer diagnosis, and others might have rules specific to gender. To get the clearest picture, you’ll want to check the specific Medicaid guidelines for your state.

What Will You Pay Out-of-Pocket?

Even when your insurance plan agrees to cover genetic testing, it doesn’t always mean the test is free. You will likely be responsible for some of the cost. Understanding your plan’s specific structure is the best way to anticipate what you’ll need to pay. Most of the time, your share of the cost will come in one of three forms.

Breaking Down Co-pays, Deductibles, and Coinsurance

Think of these as the three main ways you share costs with your insurance company. A co-pay is a fixed, flat fee you pay for a service, like a doctor’s visit or a prescription. A deductible is the total amount you must pay for your health care services before your insurance plan starts to pay. Finally, coinsurance is a percentage of the cost that you pay after you’ve met your deductible. For example, if your coinsurance is 20%, you pay 20% of the bill, and your insurer pays the other 80%. You can usually find these amounts listed clearly in your insurance plan documents.

In-Network vs. Out-of-Network Costs

To keep your costs as low as possible, it’s important to use a genetic testing lab that is “in-network” with your insurance plan. An in-network provider has a contract with your insurance company to offer services at a lower price. If you use an out-of-network lab, your insurance will cover much less of the cost, or possibly none at all, leaving you with a larger bill. Coverage rules can also be very specific; for instance, some plans may only cover testing if you have a personal history of cancer, not just a family history. Always confirm that both your doctor and the testing lab are in your plan’s network before moving forward.

Finding Financial Assistance and Payment Options

If you don’t have insurance or your plan won’t cover genetic testing, please don’t lose hope. There are still ways to manage the cost. Many genetic testing labs have patient assistance programs that can help. Some offer free testing to people who meet certain income requirements, while others provide a much lower self-pay price, sometimes under $300. You can also ask the hospital or cancer center where you receive care if they have any special funds to help patients with these costs. Organizations also maintain lists of programs that provide financial help for genetic services.

How to Get Your Genetic Test Covered

Getting insurance to cover genetic testing can feel like a challenge, but it’s entirely possible with the right approach. The key is to be proactive and organized. By working closely with your healthcare team and understanding your insurance plan’s requirements, you can build a strong case for why the testing is medically necessary for you. Think of it as a step-by-step process. Each step you complete brings you closer to getting the answers you need without facing an unexpected financial burden. Below are the practical steps you can take to get your genetic test covered.

Partner with Your Doctor and Genetic Counselor

Your journey starts with a conversation. Talk to your doctor about your personal and family health history, specifically any instances of breast, ovarian, or related cancers. They can assess your risk and determine if genetic testing is appropriate. Your doctor will likely refer you to a genetic counselor, an expert trained to discuss your family’s health history and help you understand the pros and cons of testing. This counseling session is a critical step, as many insurers require it. A genetic counselor can also help you choose the right test and explain what the results might mean for you and your family.

Secure Pre-Authorization from Your Insurer

Before you get tested, it’s essential to get approval from your insurance company. This is called pre-authorization or prior authorization. Essentially, your doctor’s office submits paperwork to your insurer explaining why the genetic test is medically necessary for you. This documentation often includes your personal and family history and the recommendation from your genetic counselor. Securing pre-authorization is the best way to confirm that your insurance will cover the cost before you receive a bill. Don’t skip this step—it can save you from a major headache and a significant expense later on.

Review Your Specific Plan Benefits

Every insurance plan is different, so it’s important to become familiar with yours. Take some time to review your plan’s documents, often called the “Summary of Benefits and Coverage.” If you can’t find it, call the member services number on the back of your insurance card and ask for details about your coverage for genetic testing. Be sure to ask about your potential out-of-pocket costs, such as deductibles, co-pays, and coinsurance. Understanding your specific plan will help you anticipate costs and ensure there are no surprises when the bill arrives.

What to Do If Your Claim Is Denied

Receiving a denial from your insurance company can be disheartening, but it’s not the end of the road. You have the right to appeal the decision. The first step is to understand why the claim was denied—the reason should be stated in the explanation of benefits (EOB) you receive. Often, it’s a matter of missing information or incorrect coding. You can work with your doctor’s office to gather the necessary documentation and submit an appeal. There are many resources available from patient advocacy organizations that can guide you through the appeals process.

Related Articles

- Genetic testing for breast cancer risk (Cost & accuracy) | Outcomes4me

- Should I Get Genetic Testing for Breast Cancer Without Risk Factors? | Outcomes4Me Community

- When should you get genetic testing for breast cancer? – Outcomes4Me

- Did You Get Genetic Testing After TNBC Diagnosis? | Outcomes4Me Community

- Gene Mutations in breast cancer – how they affect survival rate

View your personalized treatment plan in the Outcomes4Me app

Use your diagnosis to unlock personalized NCCN Guidelines®-aligned recommendations.

Frequently Asked Questions

If I have a gene mutation, does that guarantee I’ll get cancer? Not at all. Finding a gene mutation like BRCA1 or BRCA2 means your lifetime risk of developing certain cancers is higher than average, but it is not a diagnosis or a guarantee. Think of it as valuable information that puts you in control. Knowing your risk status allows you and your doctor to create a personalized screening and prevention plan, which might include earlier mammograms, more frequent check-ups, or other risk-reducing strategies.

What’s the very first step I should take if I think I need genetic testing? Your first step is to gather as much information as you can about your family’s health history. Focus on any instances of breast, ovarian, pancreatic, or prostate cancer, noting who was diagnosed and at what age. Once you have this information, schedule a conversation with your doctor. They can review your history, assess your potential risk, and if appropriate, refer you to a genetic counselor who can guide you through the next steps.

My family history is incomplete or unknown. Can I still get testing covered? This is a common situation, and it doesn’t automatically close the door on testing. While a detailed family history is very helpful, other factors can establish medical necessity for your insurer. Your personal health history, such as a cancer diagnosis at a young age, or your ancestry can also be important factors. A genetic counselor is an expert at assessing risk with incomplete information and can help you and your doctor build the strongest possible case for your insurance company.

Are the protections from GINA enough to keep my information private? The Genetic Information Nondiscrimination Act (GINA) provides strong protections. It makes it illegal for health insurers to deny you coverage or charge you higher premiums based on your genetic information. It also prevents employers from using this data in hiring or firing decisions. However, it’s important to know that GINA’s protections do not apply to life insurance, disability insurance, or long-term care insurance policies.

What should I do if my insurance company denies my request for testing? A denial can be frustrating, but it isn’t necessarily the final word. You have the right to appeal the decision. The first thing to do is find out exactly why the claim was denied, which should be explained in the notice you receive. Then, work with your doctor’s office or genetic counselor to provide any missing information and formally appeal the decision. Patient advocacy organizations also offer excellent resources to help you through this process.